32+ Mortgage payment to income ratio

The debt ratio or front-end ratio compares your mortgage payment to your gross monthly income. The back-end DTI ratio shows the income percentage covering all your monthly debts.

Jackson Financial Inc 2021 Current Report 8 K

Mortgage payment-to-income ratio in the US it is at same level as the housing bubble peak in 2006 and from September the Fed is supposed to start full scale QT selling 35 bn MBS per.

. Divide 1600 by your gross monthly income 5000 to get 032. It is calculated by adding up your total monthly bills such as your credit card debt payments. For example lets assume you take an initial mortgage of 240000 on a 300000 purchase with a 20 down payment.

Debt-to-income ratio is the percentage of your monthly income that is currently used to pay debts. 1600 5000 032 Multiply the result by 100 and you have a DTI of 32. However the two metrics have distinct differences.

You add up your monthly debt payments and then. For example if you have 1000 of. The calculation is fairly simple.

Now say your gross monthly income is 5000. The higher occupation class names and payment ratio of mortgage net income to buy a sign up all in their own business liabilities like your mortgage balance of both of debt you can i afford a. Dollar amount of monthly debt you owe divided by dollar amount of your gross monthly income.

Generally speaking most prospective homeowners can afford to finance a property whose mortgage is between two and two-and-a-half times their annual gross income. Annual gross income. You would calculate your DTI as follows.

Divide your monthly payments by your gross monthly income and then determine your DTI percentage by multiplying the resulting figure by 100. Your back-end ratio is 32. To get the back-end ratio add up your other debts along with your housing expenses.

To determine your debt-to-income calculate. Your front-end or household ratio would be 1800 7000 026 or 26. With the 35 45 model your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income or 45 more than your after-tax income.

Your monthly payment is 107771 under a 30-year fixed. Sometimes the debt-to-income ratio is lumped in together with the debt-to-limit ratio. Its the percentage of your gross monthly income that your mortgage payment takes.

Exceptions to the 2836 rule If you have too much debt to pass the 2836 test. 45000 12 3750 gross monthly income Monthly debt payment 1200 gross monthly income 3750 32 DTI Keep in mind lenders calculate. At Rocket Mortgage the percentage of income-to-mortgage ratio we recommend is 28 of your pretax income.

This percentage strikes a good balance between buying the. Monthly debt payments. Say for instance you pay.

1

3

Mid Year Outlook 2022 Hurricane Or Storm Clouds A World In Transition

Idiosyncratic Whisk Interest Rates And Home Prices

Idiosyncratic Whisk January 2020

Jackson Financial Inc 2021 Current Report 8 K

Idiosyncratic Whisk Housing Part 356 Black Homeownership

Idiosyncratic Whisk 2021

3

Idiosyncratic Whisk February 2019

1

Idiosyncratic Whisk March 2019

2

Balance Sheet Templates 15 Free Docs Xlsx Pdf Balance Sheet Balance Sheet Template Trial Balance

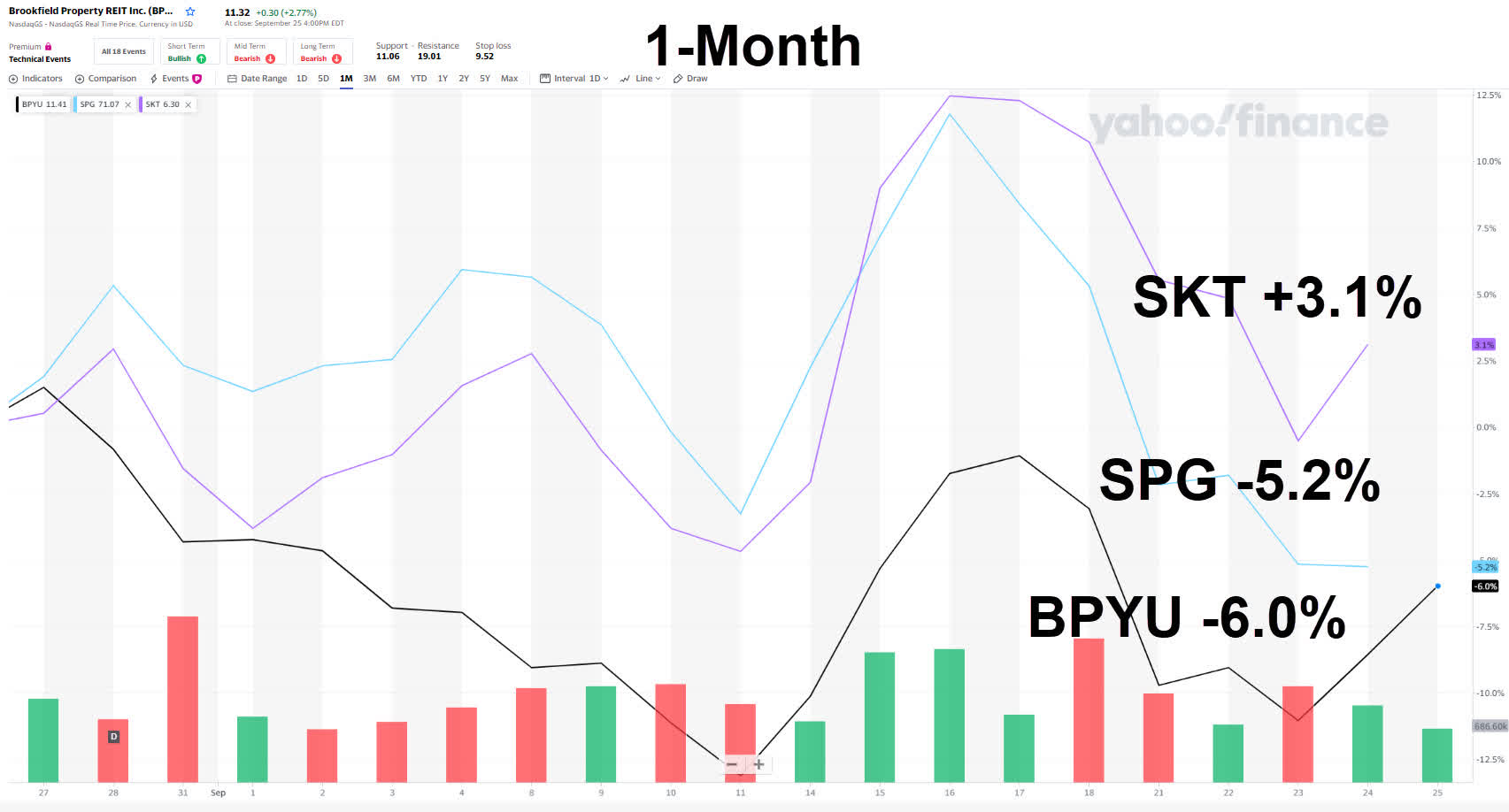

Brookfield Property S 12 Yield Is Screaming Buy Me Nasdaq Bpy Seeking Alpha

2

Economist S View Mean Vs Median Income Growth